THE STATE OF COMMERCIAL REAL ESTATE

Does the data agree that the next shoe to drop in banking is commercial real estate?

The next shoe to drop for banks is commercial real estate, particularly office, according to the current narrative.

But what does the data say?

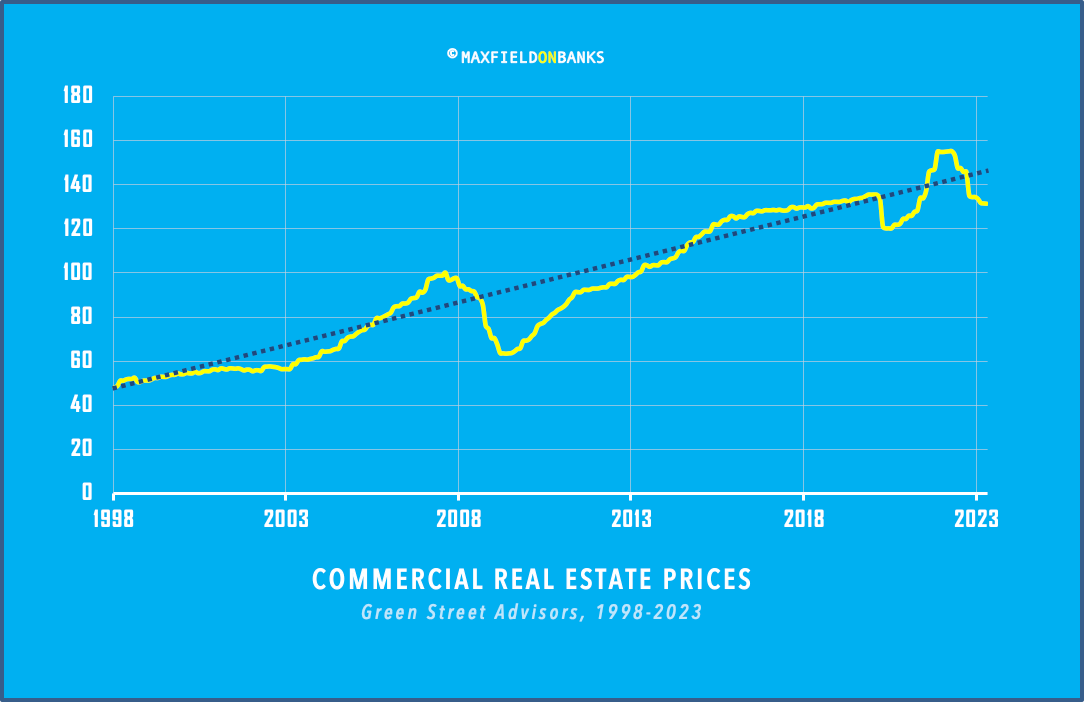

If you look at commercial real estate prices writ large, you see big fluctuations over the past three years, the latter half of which is indicative of a bubble.

Nationwide CRE prices dropped 11 percent at the start of the coronavirus crisis in the first quarter of 2020. They bottomed in the following quarter. Then they began a rapid two-year climb, barreling through the long-term trend line in mid-2021.

Since peaking in the summer of 2022, nationwide CRE prices have been on a steady descent. The catalyst came in the form of rising interest rates, which led to a 12 percent decline in CRE prices over the past eighteen months, according to data from Green Street Advisors. This leaves prices below the long-term trend line.

When you consider the impact of higher rates on negligibly profitable businesses as well as the associated decline in property values it seems reasonable to assume, in turn, that higher defaults and delinquencies are on the horizon.

Yet the further you dig, the richer the nuances, as we’ll see.