Three Stories about Ambition

Exploring the delicate balance of ambition and banking.

I’m sitting right now in my room at the Hampton Inn in Deming, NM, where I paused for a day to let a snowstorm pass through.

I was on the phone last night with a banking friend and shared a story that had been told to me by Rene Jones.

It’s one of my favorite stories.

It takes place in 2018, soon after Rene was named chairman and CEO of M&T Bank.

Rene was stepping into big shoes.

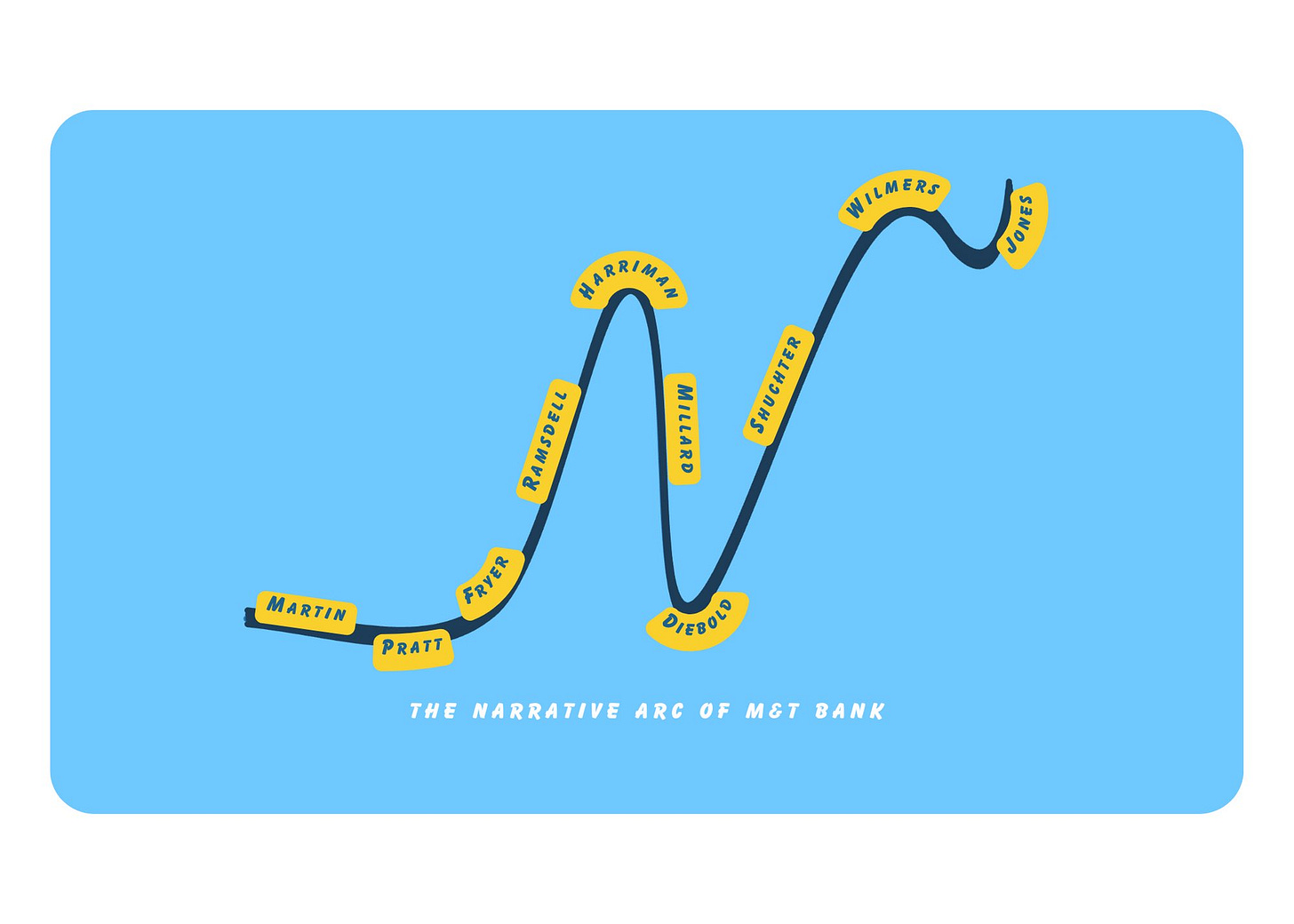

His predecessor, Robert Wilmers, had produced one of the greatest value-creation records in modern banking history. He was the Buffett of banking.

So Rene flew to Switzerland to meet with George Pereira, the former vice chairman of M&T Bank and close Wilmers’ confidante.

Pereira was a Portuguese banker from a wealthy family who helped Wilmers amass a controlling interest in M&T between 1980 and 1983, at which point Wilmers was named chairman and CEO.

Rene wanted to hear from Pereira one more time how it all happened.

Pereira cycled through narrowly avoided disaster after narrowly avoided disaster. He sold the Portuguese bank he ran, for example, a mere months before Portugal nationalized its banks. Later, he and Wilmers nearly acquired a Houston bank on the eve of the Texas banking crash in the 1980s.

The lesson?

“Don’t be too ambitious,” said Pereira.

Banking is a sport of unforced error. The harder one tries the worse one performs.

Tennis.

Ping pong.

Don’t be too ambitious.

Colorado Capital Bank was founded in 1998 as a de novo bank in Castle Pines, Colorado.

It’s a story I know intimately, as my family was collectively among the largest investors.